Creating a Superbill for Your Practice: Everything You Need to Know

Superbills help therapists simplify insurance reimbursements for clients, providing detailed documentation of services while streamlining administrative tasks and improving the therapy experience.

Apr 26, 2024

By

Team Allia

Issuing a superbill for therapy can be helpful. Unlike a regular receipt or invoice, a superbill is a detailed document that outlines the services you provide to your client.

When you give a superbill to your client, they can send it to their insurance company for reimbursement.

Yet, many therapists don’t use superbills. Why? Filling them out accurately takes time, and there's the persistent fear of rejection due to outdated or incomplete information.

Superbills contain key details like the provider's mailing address, NPI number, license number, and employer identification number. They also list relevant CPT codes as designated by the American Medical Association to represent services like individual psychotherapy. With the patient's insurance details, correctly coded superbills contain everything insurance companies need to process claims and reimburse for health expenses. Having superbills streamlines administrative processes for behavioral health providers trying to join more insurance panels, allowing them to focus on providing quality therapy sessions. For those with private practices, managing insurance claims with free superbill templates saves significant time that can better be spent on client care.

In this article, we’ll clear the confusion related to technical aspects of billing codes, and address the common challenges therapists face in the process.

We will also explore how to create a superbill for your therapy practice that can easily get reimbursed by your client.

But first, let’s find out how superbills work and who exactly needs one.

How Do Superbills Work?

Ever wondered why insurance asks therapists to fill out this massive receipt? Well, they're making sure you're legit and providing the services your client says you are.

They want to avoid a situation where anyone could claim reimbursement, even if they're not actually getting any healthcare.

Your client pays you the full fee, and they're the ones dealing with the reimbursement insurance. Your only extra task is to hand over that superbill receipt. It's a pretty smooth setup.

Now that you're aware that some of your patients might ask for superbills, it's important to understand how the whole system operates and where superbills fit into your daily routine.

When you outline the billing procedures in your therapy practice, you probably collect payment either before the therapy session or immediately after.

Once the payment is in, you'll need to create a superbill and dispatch all the necessary details to the insurance company for the patient's reimbursement.

Alternatively, you can hand over a superbill to your patient and let them take charge of sending it in.

Who Needs a Superbill?

Client-Initiated Superbills

Typically, a superbill gets created when the client asks for it. In some cases, mental health professionals make it a standard practice to issue superbills.

These practitioners believe that by providing superbills, clients will then be in charge of seeking reimbursement from the insurance company.

While this is true in many cases, the majority of clients won't actually submit the superbill for their sessions.

Out-of-Network Situations

Another scenario where a superbill becomes essential is when a therapist is out-of-network, and the client prefers not to cover the entire cost of the service provided.

Submitting insurance claims and receiving reimbursement as an out-of-network provider can be challenging. Behavioral health providers must determine the appropriate diagnosis codes, CPT codes, and place of service codes that match the service provided in each patient visit. They also need the client's insurance information, including diagnosis codes required by their insurance company. By using a superbill template, healthcare providers can quickly gather this basic information, submit claims for services rendered, and get reimbursed for services provided out-of-network.

In such cases, the client aims to use their out-of-network benefits. Let’s get to know the difference between in-network billing and out-of-network billing in a private practice.

Differences between in-network and out-of-network billing

In in-network billing, a therapist must be affiliated with a specific insurance panel to directly bill insurance for session reimbursement.

Clients typically pay a small copay directly to the therapist, who then needs to submit a claim to the insurance company to receive the remaining payment.

On the other side, out-of-network billing is for therapists who have a formal contract with an insurance panel.

Instead of the in-network approach, therapists charge the client the full fee upfront.

The insurance panel then directly reimburses the client, with coverage varying depending on the specific insurance policy.

Some policies may not offer any out-of-network benefits, while others provide substantial coverage for these sessions.

Considerations for Out-of-Network Benefits:

There are some other factors you should consider when dealing with a client about using their out-of-network benefits.

Deductible Impact:

Most insurance plans have a substantial out-of-network deductible.

Clients may need to pay the full session fee until the deductible is met.

The value of out-of-network benefits increases post-deductible when copays or coinsurance kick in.

Limited Coverage:

Even after the deductible is met, insurance typically covers only 50% of the therapist's session fee.

They may remain more costly compared to in-network alternatives.

Provider Qualification:

Mental and behavioral health providers must be listed as qualified out-of-network service providers with the client's insurance company.

If the therapist isn't listed, superbills may be denied, potentially requiring the client to cover the entire service cost.

Risk Awareness:

Ensure clients understand the potential risks associated with using out-of-network benefits.

Providing clarity on potential costs and denial risks is crucial before opting for superbill reimbursement.

Benefits of Issuing Superbills

Affordability for All

Superbills are useful for people who can't afford therapy upfront. By issuing superbills, you open the door for patients who may struggle with out-of-pocket costs.

For instance, a student dealing with stress may find it feasible to attend therapy if they know reimbursement is an option.

Patient Comfort and Attendance

Especially in cash-based clinics, superbills make therapy more accessible. When patients know there's a chance for reimbursement, they're more likely to agree to attend sessions.

They can also focus on their healing and not worry about the financial burden.

Imagine a person dealing with anxiety – the reassurance of potential reimbursement can encourage them to prioritize mental health.

Attracting and Retaining Insured Patients

Superbills can attract patients with health insurance. This can also fuel the growth of your practice.

If someone with insurance comes to your therapy clinic because they like that they can get some money back and trust the good care they'll receive, it's more likely they'll keep coming back to see you regularly.

Paperwork Relief and Payment Confidence

Issuing superbills means you don't have to waste your time with insurer paperwork. You can use this time to focus more on your patient’s well-being.

Plus, superbills can also motivate you to request payment upfront, creating a smoother process.

For instance, after each session, you can focus on helping your clients rather than stressing over administrative tasks and payment.

Common Challenges Faced by Therapists in Creating a Superbill

Technical Confusion

Therapists often struggle with technical jargon and procedures when it comes to creating superbills.

The process can be overwhelming, from decoding billing codes to selecting the right ones for various services and diagnoses.

Uncertainty about the specific information insurers need on superbills adds another layer of complexity.

Many therapists also struggle with understanding the typical format and the necessary sections for a comprehensive superbill.

Monitoring Insurance Requirements

Staying on top of the ever-evolving requirements set by insurance companies for superbills can be a daunting task.

Therapists face the challenge of regularly checking and comprehending the changes in templates and information criteria to ensure compliance.

Staying alert is super important to avoid having insurance claims rejected. If you miss or misunderstand the latest rules, your claims might not go through.

Changes in ICD-10

The International Classification of Diseases, specifically ICD-10, undergoes periodic updates, and therapists must stay informed to avoid any issues.

It can be hard to keep up with the changes in classifications and make sure you're not using old or unapproved codes when you send in superbills.

The tricky part is finding the right balance between being accurate and dealing with the ever-changing ICD-10 system.

Billing for Different Services

Therapists sometimes find it challenging to figure out how to charge for different things like therapy sessions, assessments, and group sessions.

It's not always clear what details are needed on the superbill for each type of service, making an already complicated process even more confusing.

Revenue Loss and Mistakes in Billing

Therapists worry a lot about losing money if they make mistakes in how they bill for their services.

They feel anxious about the financial problems that might come up if they don't get their superbills right.

The fear of audits and penalties for doing billing and paperwork wrong makes the process stressful.

Reimbursement Worries

Therapists are often worried about getting paid back for their services.

They're afraid payments might be delayed or rejected by insurance companies because of problems with their superbills.

This uncertainty can cause challenges in managing their practice smoothly.

Dealing with Delayed Payments and Additional Information Requests

Therapists often face a common problem when dealing with insurance companies asking for more information or delaying payments.

It's frustrating and takes a lot of time to handle these requests, making the billing process even more of a hassle.

Cost of Hiring Billing Specialists

For many therapists, hiring people to help with billing brings extra costs.

The money spent on getting help with billing, along with the time it takes to learn billing on their own, creates a tough situation.

They have to figure out how to balance the money they spend by making sure their billing is done right.

Securing Patient Data

Protecting your patient's information should be your priority. Think of HIPAA rules as your guide.

Avoid using tools like Google Forms or Gmail without a BAA agreement – they're not HIPAA-compliant.

Make sure your data handling is secure and compliant to overcome the challenge of protecting sensitive patient information.

Deciding When and What to Charge Your Client

Determining when and what to charge your client is not so straightforward, especially with the introduction of the No Surprises Act.

In the pre-No Surprises Act era, providers could issue a superbill and charge the full session fee to the client.

For instance, if a therapist's regular rate was $200, they could bill the client the complete amount, and any payment from the insurance would go directly to the client.

This offered a simple method for providers to receive their full fees while still making some allowances for the insurance company.

However, with the implementation of the No Surprises Act, mental health providers must now understand the limitations when using out-of-network benefits.

In certain states, providers can no longer charge their regular rate; instead, they must bill the patient the amount the insurance would have paid for the services.

Therapists need to navigate these changes and understand the specific rules applicable to their private practice.

How to Make a Superbill for Therapy Clients

Creating a HIPAA-Compliant Superbill

Let’s discuss how to create a superbill that follows the rules of HIPAA. Here are a few ways to make sure your superbill is in line:

1. Password-Protected Documents or Ready-Made Templates:

You can start by making a superbill in a password-protected document, using data from your CRM. Alternatively, you can go for a ready-made template and fill it in manually.

2. Automated Superbill Creation:

Consider using a platform that automates superbill creation.

But keep in mind, because of changes in insurance company requirements, this method might sometimes lead to superbill rejection.

3. Streamlining Workflow for Smooth Superbilling:

Automate Invoicing: If you already have information for regular invoices, you've got most of what you need for a superbill.

Automate Payment Processing: Always know how your patients are paying by automating payment acceptance.

Track Payments: Keep tabs on payment statuses to lower the chances of late payments.

Update Client Profiles: Regularly update client profiles. Notify them to check their info or use HIPAA-compliant forms to fill in any missing details.

Transparent Invoicing: Send invoices to your clients, transparently communicating about potential costs and avoiding hidden fees. This keeps them informed about their expenses and what their reimbursements cover.

4. Superbill Management:

Don't forget to send, track, and keep an eye on your superbills. The most common slip-up is not checking the status.

Sometimes, they get rejected, and insurance providers might need more info. If you don't follow up, reimbursement could take ages.

By following these steps, you can simplify the superbill process, making it efficient and in line with HIPAA regulations.

Creating a Superbill for Out-of-Network Billing

Once you've got your template in place, filling it out when your client needs one for out-of-network billing is quick and easy.

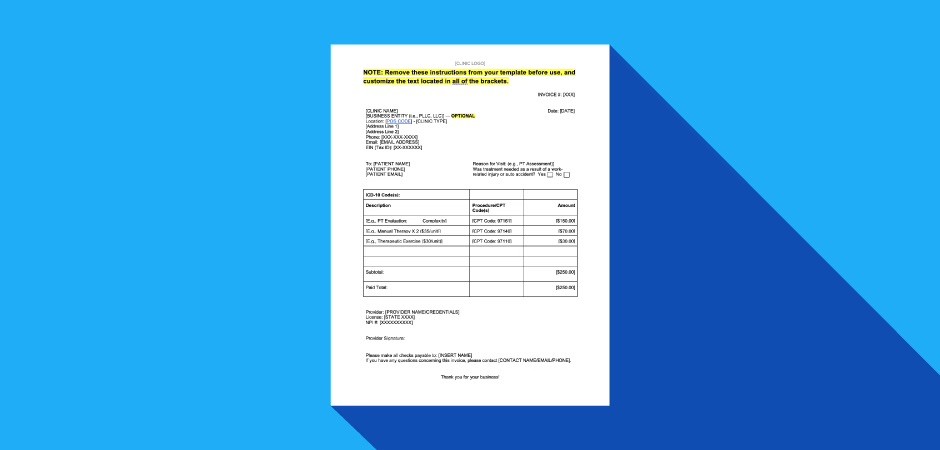

Let's break down the key components to include on your superbill receipt:

Set Up a Superbill Template:

Make a simple template for efficient out-of-network billing.

Basic and Professional Information:

Your Name: First and last name, and business name if applicable.

Address: Include your mailing address for potential insurance contacts.

Basic Contact Information: Phone number and email address.

Your Professional Information:

Tax ID Number: Obtain an EIN (Employer Identification Number) if you haven't already.

NPI Number: Use your existing NPI or apply for one if needed.

License Number: Include your license or credentialing details for practicing psychotherapy.

Your Client's Information:

Client's Name: Include your client's first and last name.

ICD-10 Code: Most insurance companies require a diagnosis code for processing claims.

Client's Date of Birth: Essential information for processing insurance claims.

Itemized List of Services:

Date of Service: Include the date of your client's session.

CPT Code: Representing the type of service provided.

Description of Service: Name of the service associated with the CPT code.

Cost of Service: Amount charged to your client for the billed CPT code.

Place of Service Code:

Use the correct code for where you meet with your client (e.g., office, in-home services, telehealth).

Statement of Payment:

Include a statement highlighting that the client has already paid the balance in full. This avoids potential payment confusion.

Sign and Date the Superbill:

Add your signature and the date to finalize the superbill.

Personalizing the Superbill Experience:

Provide payment options to patients for a smooth payment process.

Add a personal touch to the superbill.

Use polite language like "please" and "thank you."

Include special messages for birthdays or significant life events.

Mention any special offers or discounts.

Create a Superbill With Allia's Easy-to-Use Software

Creating superbills doesn't have to be a hassle, especially if you're a therapist who prefers staying out of the insurance panel loop.

It's all about making things safe and easy for both you and your patients. You want the process to be as smooth as possible. And that's where Allia's easy-to-use software comes in.

With Allia’s assistance, you can create accurate and HIPAA-compliant superbills effortlessly to help your patients receive reimbursements.

More from Allia

Dec 16, 2024

Managing No-Show and Late Cancellation Clients in Therapy Practice

Managing No-Show and Late Cancellation Clients in Therapy Practice

Sep 12, 2024

How to conduct a therapy intake session? A detailed guide

How to conduct a therapy intake session? A detailed guide

Sep 11, 2024

A Guide to Billing Insurance for Therapy for Mental Health Professionals

A Guide to Billing Insurance for Therapy for Mental Health Professionals